Need a receipt?

Directions for how to obtain a receipt are printed on your bill. Send the taxpayer copy of the bill and a self-addressed stamped envelope to 1286 Black Rock Rd, Phoenixville, PA 19460 and a receipt will be stamped and returned to you. Please consider requesting a receipt when you make payment. You DO NOT need a stamped receipt for your tax return. Your cleared check is proof of payment. If your mortgage company pays your real estate taxes they should provide you a 1098-Mortgage Interest statement. The only time a stamped receipt is required is for the PA Property Tax Rebate program

Need a copy of your bill?

As noted on your bills, you should keep a copy for your records. If you need an additional copy, there is a $10 duplicate bill fee. Send your request and duplicate bill fee to 1286 Black Rock Rd, Phoenixville, PA 19460. Please make sure to specify which bill you need a copy of - county/township real estate tax bills? School real estate tax bill? For what year? If you include your e-mail address on your request I can e-mail a copy of the bill back to you. If you require a hard copy, please include a self-addressed stamped envelope.

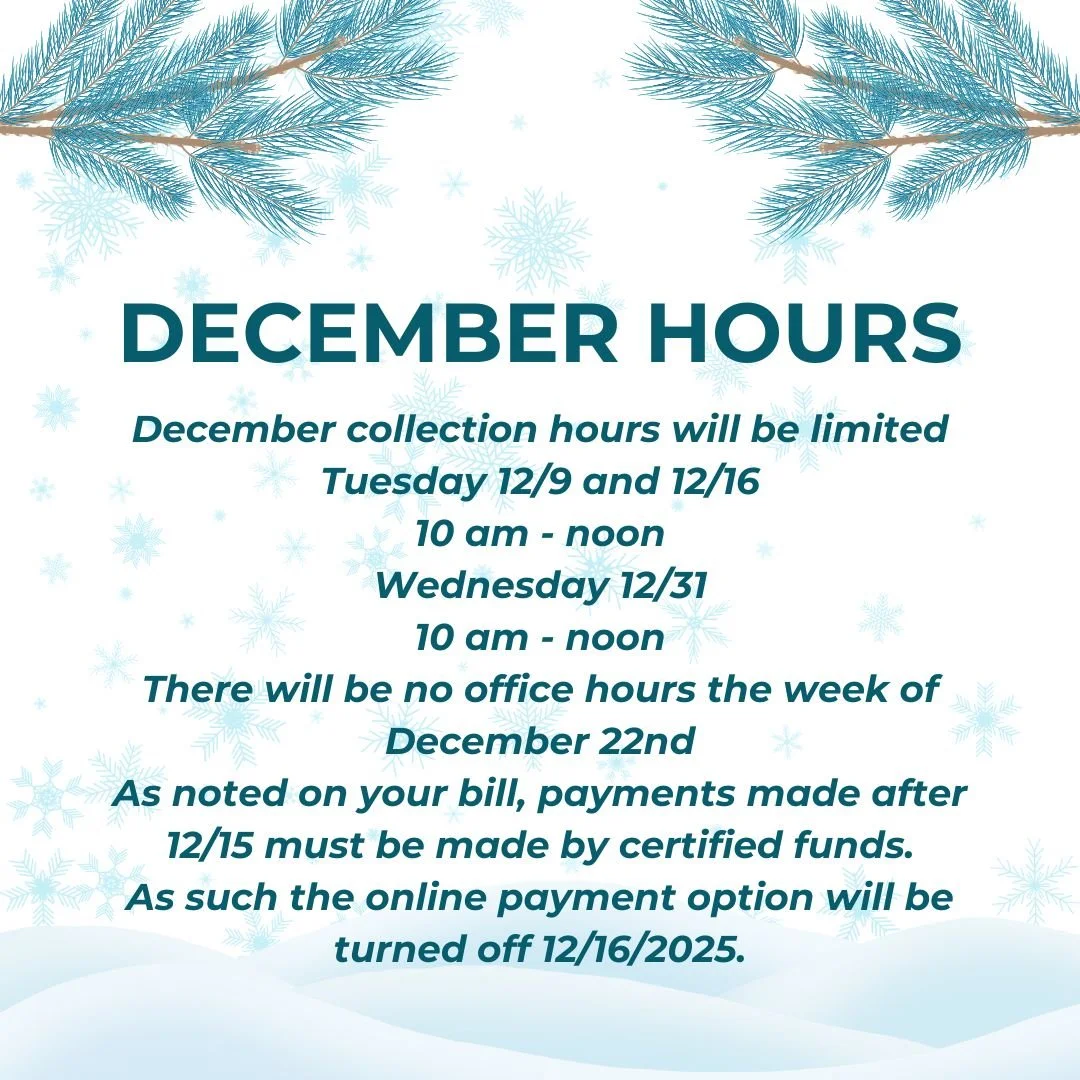

Online Payments

Online Payments, both echecks and credit cards, are processed by MuniciPay. MuniciPay charges $1.50 to process an echeck and 2.65% to process a credit card payment. I am unable to waive these fees and they are non-refundable. Please make sure when paying online the amount you are paying matches the amount on your bill. Partial payments are not permitted, BY LAW. If you submit a partial payment it will be returned to you. When you click the link below it will ask you for an account number. This is your parcel number, starting with 61, without the hyphen. First installments CANNOT be made through the online system. As noted above, by law in PA you cannot make a partial payment, this is why MuniciPay shows your total amount due. Once the 1st installment has been received and posted your account will be converted to installments and the 2nd and 3rd installments can be made online.